Millennials’ Wealth Has Grown by 50% in the Past Four Years, Stripping Them of the “Broke Generation” Stereotype

Millennials are now the wealthiest generation among Americans under 40 years old. New research reveals that adults aged 28 to 43 are increasing their wealth.

Over the last five years, millennials saw their wealth increase faster than any other generation in the data series’ history.

What Is the CAP?

Since the late 1980s, the Center for American Progress (CAP) has tracked quarterly estimates of the distribution of U.S. household wealth. By CAP’s definition, household wealth is an accumulation of stocks, bank accounts, and real estate minus liabilities including mortgages and student-loan debt.

Source: Timothy Krause/Wikimedia Commons

Despite almost a decade of millennial woes, CAP has reported that the generation is the wealthiest it has ever been.

Millennials Wealth Grows

According to a report from CAP, millennials are seeing their average wealth increase to $259,000 annually. This represents an $85,000 increase in just five years.

Source: Austin Distel/Unsplash

The increase is likely to be seen across all income types, not just among ‘a small group of wealthy young people driving these gains,’ according to the CAP report.

The Great Wealth Transfer

This influx of wealth stems from the great wealth transfer, which millennials receive from their parents or grandparents through inheritance.

Source: Karolina Grabowska/Pexels

Additionally, millennials have become more adept at managing their finances and investing wisely to ensure their money works for them.

Baby Boomers Finally Help Millennials

Chief strategy officer and head of new developments at a global real estate company, Engel & Völkers, Stuart Siegel tells Fortune that the great wealth transfer was a sign of relief for many struggling millennials.

Source: Pixabay/Pexels

“Baby boomers are purposely sharing assets with their children over a longer trajectory, and unconnected to a death or health event,” Siegel says.

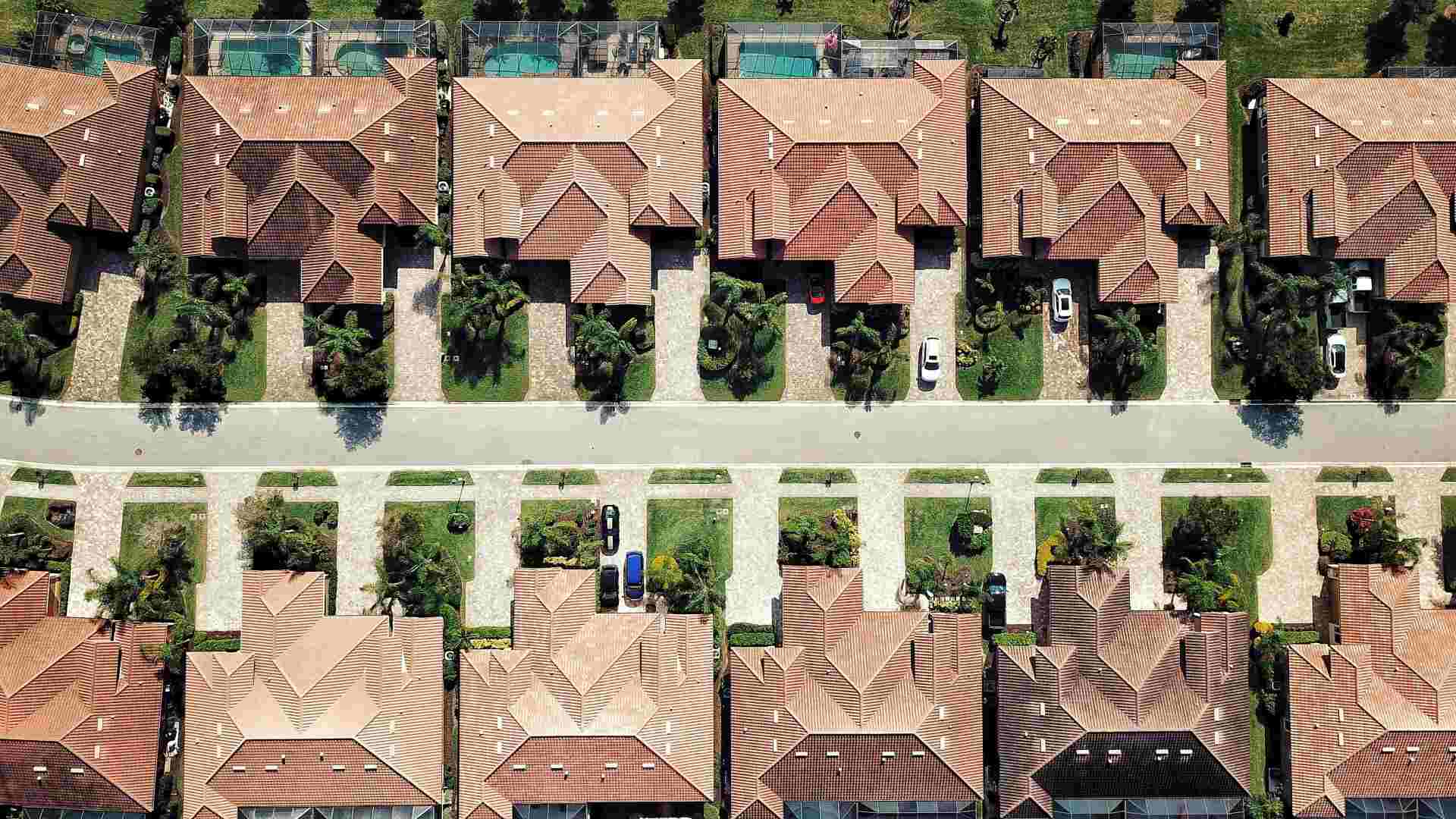

Millennials Leverage Their New Wealth

Millennials are “looking to leverage it even more through earlier access,” Siegel says. “If a parent will help them with a real estate down payment when they identify an opportunity, they can be opportunistic and begin actively developing their own investment portfolio that much sooner.”

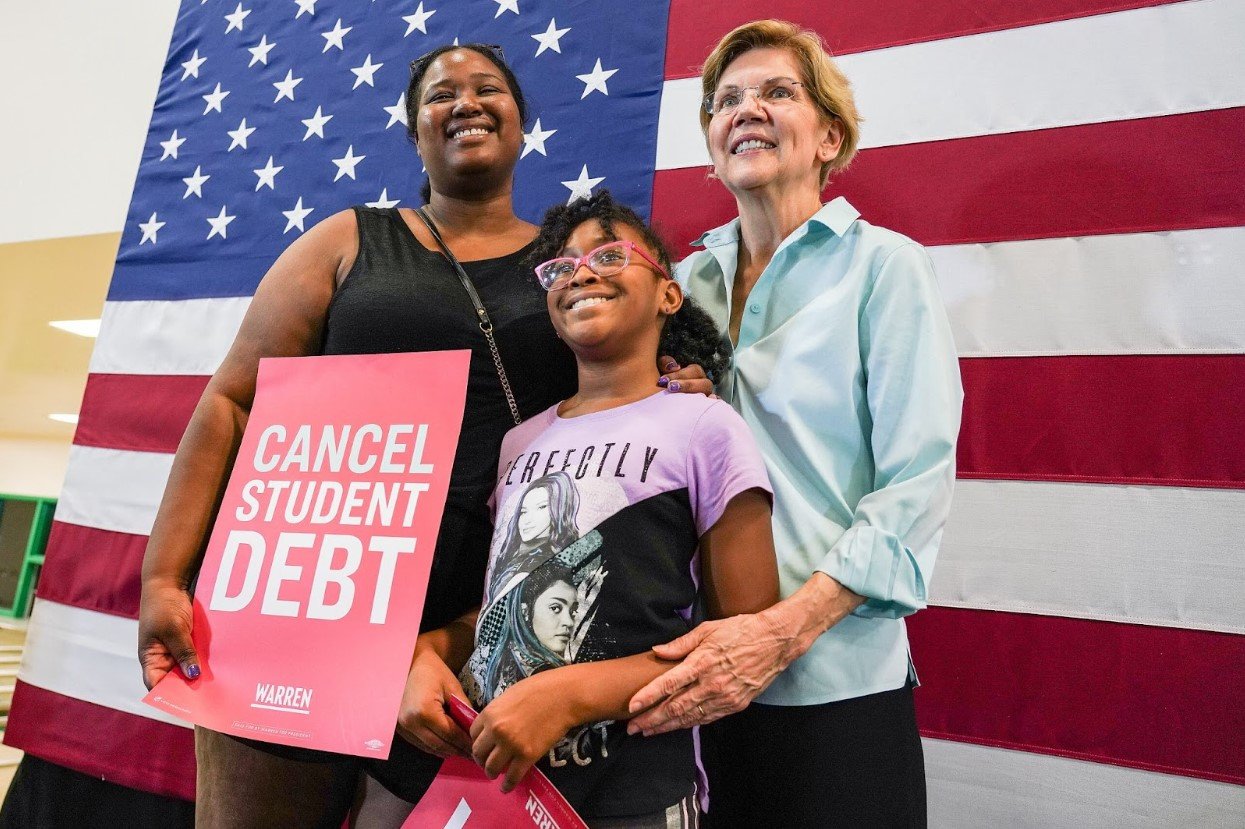

Source: Elizabeth Warren-Henderson Town Hall/Wikimedia Commons

The sooner millennials can purchase a home, the sooner they can build a portfolio of meaningful wealth.

Where Millennials Are Putting Their Money?

The major ways millennials are gaining wealth are through housing, liquid assets, personal business, stocks, major purchases, and credit card and student loan debt, according to CAP’s analysis.

Source: Ameer Basheer/Unsplash

While not every millennial can afford a house, this is the area where many in the age group are demonstrating their wealth.

Millennials Are “House Rich”

Housing wealth–which CAP defines as home value minus mortgage debt–rose $22,000 between 2019 and 2023.

Source: RDNE Stock project/Pexels

While this housing wealth doesn’t apply to everyone in the generation–major challenges still exist for many members of the younger generation who want to break into the housing market–millennials are the driving force behind the housing market.

How Millennials Become House Rich

“Millennials that saved [and] invested as well as purchased homes soon after entering the workforce are most likely in okay to strong financial positions,” Mark Johnson, a professor and investments and portfolio management fellow at Wake Forest University School of Business, tells Fortune.

Source: Freepik

“Additionally, extended periods of low-interest rates and low inflation helped boost asset values—thus contributing to creating wealth—for the majority of millennials’ working years.”

Debt Is Lower Than Ever for Millennials

While the struggles to buy homes, pay off student debt, and save for retirement have plagued many millennials and other young adults, those entering their 30s are beginning to see their financial burdens ease.

Source: Frederick Warren/Unsplash

Credit card and student loan debt have dropped by $5,000, helping boost the overall net worth of millennials.

Lingers Effects of the COVID-19 Pandemic

Some effects of the pandemic, such as pausing student loan payments and canceling travel and entertainment plans, may have contributed to reducing individuals’ debt and increasing their savings.

Source: Anastasia Shuraeva/Pexels

However, the pandemic also triggered a sharp recession, resulting in market declines and millions of workers being laid off. These layoffs continue to affect hundreds of thousands of Americans, forcing many back into entry-level positions due to the loss of their pre-existing jobs.

Millennials Are Financially Stronger Than Ever

While the government is doing what it can to help prevent the recession and eliminate the staggering debt the county and its citizens have accumulated, millennials are poised to recover faster and stronger than anyone else.

Source: Freepik

The average wealth among millennials increased by around 101 percent, after adjusting for inflation, between the end of 2019 and the end of 2023.