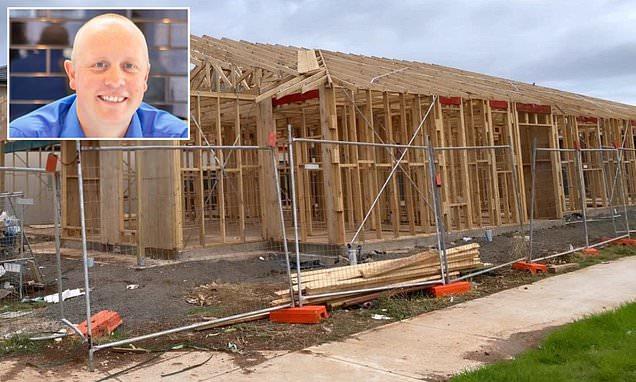

Geelong Building Solutions Pty Ltd has entered liquidation. The company owes nearly $1 million to creditors.

This collapse adds to the growing list of failed construction firms. It highlights the financial pressures facing the Australian building industry.

Finance Providers Bear Brunt of Builder’s Debts

Major creditors include Shift Financial, NAB, and Prospa Advance. These finance providers are owed a combined $693,000.

The situation underscores the risks faced by lenders in the construction sector. It may lead to tighter lending practices for builders.

Covid-19 and Fixed Contracts Cited in Collapse

The company director blames Covid-19 and fixed-price contracts for financial difficulties. Rising costs during the pandemic squeezed profit margins.

This scenario is common among recent construction industry failures. It illustrates the long-term impacts of the pandemic on businesses.

Economic Downturn Impacts New Home Construction Orders

Fewer new builds contributed to the company’s cash flow problems. The economic slowdown has reduced demand for new homes.

This trend affects the entire construction industry. It signals potential broader issues in the housing market.

Nearly 3,000 Construction Companies Collapsed Last Year

ASIC reports almost 3,000 construction firm failures in the last financial year. This high number indicates systemic issues in the industry.

Factors include rising costs, labor shortages, and market uncertainties. The trend raises concerns about the sector’s stability.

National Housing Targets Under Threat Amid Shortages

Australia is falling short of its 1.2 million new homes target by 2029. The Master Builders Association predicts a 166,000 home shortfall.

This gap exacerbates the existing housing crisis. It puts pressure on governments to address construction industry challenges.

States Lag Behind Nationally-Agreed Housing Goals

Every Australian state is failing to meet housing targets. This nationwide shortfall contributes to rising home prices.

It indicates a systemic problem in housing policy and implementation. The situation calls for coordinated action across all levels of government.

Federal Government Accused of Slow Crisis Response

Critics argue the federal government is not acting quickly enough. The housing crisis requires urgent and comprehensive solutions.

Delays in addressing the issue worsen affordability problems. It highlights the need for more aggressive policy interventions.

Builder Prioritized Client Homes Over Financial Health

The company director completed all client builds despite financial strain. This decision protected homeowners but worsened the company’s position.

It raises questions about the balance between client and business interests. The case illustrates the ethical dilemmas faced by struggling builders.

Industry-Wide Challenges Threaten Housing Supply Goals

The builder’s collapse is symptomatic of broader industry issues. Achieving national housing targets seems increasingly unlikely.

This situation may lead to long-term housing affordability problems. It calls for a reassessment of construction industry support and regulation.